Telangana-scheduled-castes-cooperative-financeTelangana State Financial Corporation Apply Process

Telangana State Financial Corporation (TSFC) is a key financial institution providing crucial support to small and medium enterprises (SMEs) in Telangana. TSFC offers term loans and working capital loans to help SMEs grow and thrive in the competitive market. E loans business expansions, infrastructure development, and working capital needs ki support chestayi. TSFC loan application process simple and straightforward ga undi, with a focus on transparency and efficiency. SMEs ki financial assistance ichhi, Telangana’s economic development ki TSFC pramukh role play chestundi

Eligibility Criteria

TSFC nunchi loan disbursals kosam, small and medium enterprises (SMEs) Telangana lo operate cheseyyali. Mee business registered and operational undali, with valid licenses and permits. Financial stability proof chupi nchali, including positive cash flow and profit records. Kotha businesses ki, promoter’s background, qualifications, and experience chudutundi. Minimum turnover and specific sector requirements kuda undachu, so vay need ni meet cheyandi. Applicants should not have defaulters record with any financial institution. Credit score kuda chudutundi, so maintain cheyandi.

Required Documentation

Loan application process kosam, essential documents ready pettandi. Business registration certificates, licenses, and permits submit cheyandi. Last three years financial statements, like balance sheet, profit and loss statement kuda add cheyandi. Current year’s performance and future projections kuda include cheyali. Promoters and directors’ KYC documents, like Aadhaar, PAN, and address proofs kavali. Loan purpose clear ga explain chese business plan submit cheyandi. Collateral security documents kuda attach cheyandi, if applicable.

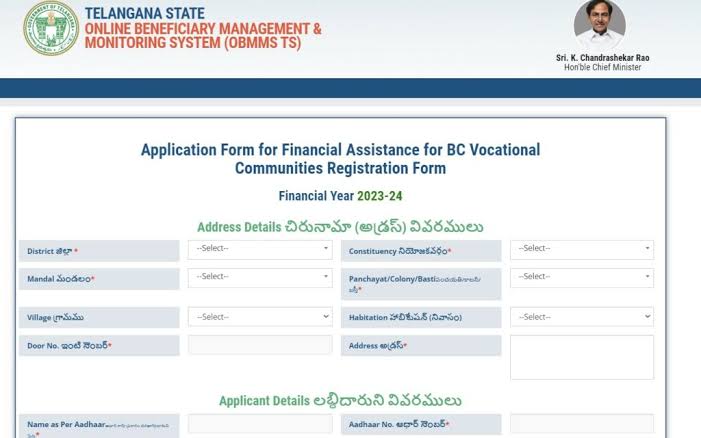

Loan Application Form

Loan application form TSFC office nundi, lekapote TSFC official website nundi download chesukondi. Form lo all relevant details fill cheyandi, like business name, address, contact details, and loan requirement. Promoters and directors details, financial information, and loan purpose kuda accurate ga mention cheyandi. Attach necessary documents mentioned in the checklist. Form lo any additional information required undey, proper ga provide cheyandi. Errors avoid cheyali, as incomplete forms reject avvachu.

Application Submission

Completed loan application form, along with required documents, TSFC office lo submit cheyandi. Online application kuda accept chestharu, so TSFC website lo login ayi upload cheyandi. Application fees, if any, pay cheyandi. Submission time lo acknowledgement receipt tesukondi. Application submit chesaka, follow-up cheyadam important, so that status update kosam contact maintain cheyandi.

Initial Screening and Assessment

Application submit chesina ventane, TSFC team initial screening and assessment start chestaru. Submitted documents verify chestaru and eligibility criteria meet avuthunara chudutundi. Financial stability, repayment capacity, and loan purpose evaluate chestaru. Initial screening lo doubts unte, applicants ki contact chestaru for clarification. Screening process lo, incomplete or incorrect applications reject avvachu.

Site Visit and Due Diligence

Initial screening complete ayyaka, TSFC team site visit ki arrange chestaru. Business location visit chesi, actual operations, infrastructure, and resources assess chestaru. Due diligence process lo, financial records, business activities, and collateral security (if any) thorough ga verify chestaru. Promoters and directors interview kuda chestaru, to understand their business vision and commitment. Site visit and due diligence process accurate and transparent ga undali, to ensure loan sanction.

Approval and Sanction Process

Due diligence satisfactory ga complete ayyaka, loan approval process start chestaru. TSFC loan committee application evaluate chesi, final decision teesukuntaru. Approval process lo, loan amount, interest rate, repayment tenure decide chestaru. Loan sanction letter issue chestaru, lo loan terms and conditions clear ga mention untayi. Applicants loan terms accept cheyali and necessary agreements sign cheyali.

Disbursement of Funds

Loan sanction ayyaka, disbursement process start avuthundi. Approved loan amount, applicant’s bank account lo transfer chestaru, as per agreed terms. Disbursement stages lo, project progress or working capital requirements consider chestaru. Applicants periodic progress reports submit cheyali, to ensure funds proper ga use chesuthunnara ane. Repayment schedule, as per agreed terms, timely follow cheyandi to maintain good credit record.

Official Website: Click